Resources

Firm Insights

Federal Agencies Cracking Down on Coronavirus-Related Criminal Behavior

A memorandum to all United States Attorneys issued last week by Attorney General William Barr directed:

“[e]very U.S. Attorney’s Office . . . to prioritize the detection, investigation, and prosecution of all criminal conduct related to the current pandemic.”

As head of the Department of Justice (DOJ), Barr is responsible for overseeing all United States Attorneys, the head federal prosecuting attorney in each of the United States’ 94 judicial districts (including the Eastern District of Missouri and the Southern District of Illinois).

According to Barr’s Memorandum,

“there have been reports of individuals and businesses selling fake cures for COVID-19 online and engaging in other forms of fraud, reports of phishing emails from entities posing as the World Health Organization or the Centers for Disease Control and Prevention, and reports of malware being inserted onto mobile apps designed to track the spread of the virus.”

In his directive Barr stated,

“The pandemic is dangerous enough without wrongdoers seeking to profit from public panic and this sort of conduct cannot be tolerated.”

The Rise of the Coronavirus Fraud Coordinator

In a follow-up memorandum later last week, Deputy Attorney General Jeffrey Rosen directed each U.S. Attorney to appoint a “Coronavirus Fraud Coordinator” responsible for conducting outreach and raising awareness, serving as legal counsel on matters relating to Coronavirus, and directing the prosecution of Coronavirus-related crimes.

The DOJ has identified a number of examples of such offenses, which, in addition to those set forth in Barr’s memorandum, also include fraudulently seeking donations for illegitimate or non-existent charities and medical providers fraudulent billing through the use of patient information ostensibly obtained for COVID-19 testing.

Financial Crimes Enforcement Network COVID-19 Crackdown

In addition to DOJ, other federal agencies have also sounded alarms about – and in some cases, taken action against – actual and potential criminal behavior connected with COVID-19. On the same day Barr issued his memorandum, the Financial Crimes Enforcement Network (FinCEN), a division within the United States Department of the Treasury, released a statement encouraging “financial institution to communicate concerns related to . . . COVID-19 and to remain alert to related illicit financial activity.”

FinCEN’s Four COVID-19 “emerging trends”:

| “Impostor Scams,” in which “bad actors attempt to solicit donations, steal personal information or distribute malware by impersonating government agencies . . . international organizations . . . or healthcare organizations”; | ||

|---|---|---|

| “Investment Scams,” such as “promotions that falsely claim that the products or services or publicly traded companies can prevent detect, or cure coronavirus”; | ||

| “Product Scams,” relating to “unapproved or misbranded products that make false health claims pertaining to COVID-19,” and “fraudulent marketing of COVID-19-related supplies, such as certain facemasks”; and | ||

| ??Insider Trading | ??. |

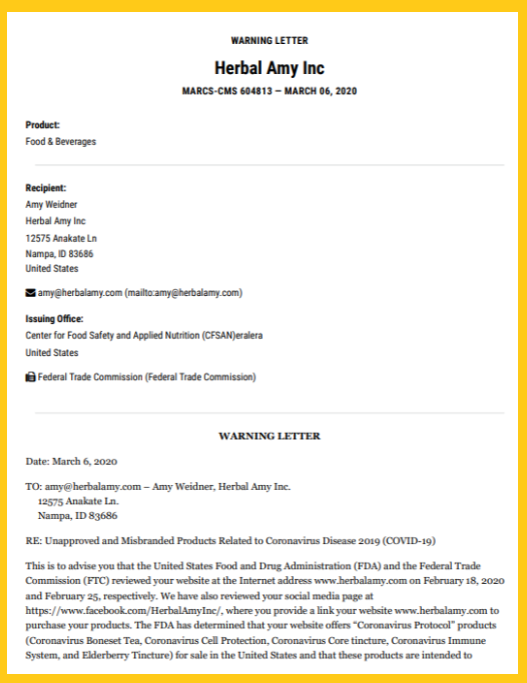

Federal Trade Commission COVID-19 Crackdown

Indeed, on March 9, the Federal Trade Commission (FTC) and the Food and Drug Administration (FDA) issued warning letters to seven companies whom those agencies believed were unlawfully selling products “claiming they can treat or prevent the Coronavirus.”

The letters demanded that the companies “notify the FTC within 48 hours of the specific actions they have taken to address the agency’s concerns.”

Last Thursday, the FTC posted on its website that “[s]o far, all of the companies have made big changes to their advertising to remove unsupported claims.”

In that same website post, the FTC also listed other types of “scams we’re seeing,” including undelivered goods; fake charities; and fake emails, texts and phishing.

Securities and Exchange Commission COVID-19 Crackdown

As FinCEN’s reference to “insider trading” might suggest, the Securities and Exchange Commission (SEC) is keeping a watchful eye on potentially criminal trading behavior related to Coronavirus-related activities. Twice in February – way before news broke last week of possible insider trading by United States Senators – the SEC suspended trading of two companies (both of which appeared to be marketing treatments for Coronavirus) based upon concerns about the adequacy, accuracy and reliability of information concerning the companies.

And last week the SEC stated that it is:

“actively monitoring our markets for frauds, illicit schemes and other misconduct affecting U.S. investors relating to COVID-19 – and as circumstances warrant, will issue trading suspensions and use enforcement tools as appropriate.”

As FinCEN put it, some of the actual and potential misdeeds relating to the Coronavirus are “similar to those that occur in the wake of natural disasters.”

![]()

In other words, whenever disaster or crises strike, scams and frauds, sadly and invariably seem to follow. Potential targets should be on the lookout for these types of behaviors so as to avoid becoming victims.

Potential perpetrators should scrutinize their own actions so as to avoid becoming defendants – and, potentially, guests of the United States Bureau of Prisons.

Sorry, we couldn't find any posts. Please try a different search.

The choice of a lawyer is an important decision and should not be based solely upon advertisements.

Let's Work Together

If you have questions, we’re ready to help you find the answers.

Newsletter Sign-up

Join our mailing list and stay up to date with Capes Sokol!

By clicking the “Subscribe” button you

agree with our Terms and Conditions.