Resources

Firm Insights

Boxerman on Bitcoin – Part I: An Introduction to Bitcoin

Yes, It’s Legal.

A Brief Overview of Bitcoin and Bitcoin-Related Issues

In recent years, our firm’s White Collar Criminal Defense and Internal Investigations practice group has handled a number of matters involving Bitcoin. When I mention this growing area of practice to others, the first question I usually get is, “What is Bitcoin?” The next question invariably is, “Is that even legal?”

Bitcoin was the first widely-used “virtual currency” or “cryptocurrency”. The Financial Crimes Enforcement Network (“FinCEN”), a unit within the United States Treasury Department, describes a virtual currency as:

“a medium of exchange that operates like a currency in some environments, but does not have all the attributes of real currency. In particular, virtual currency does not have legal tender status in any jurisdiction.”

Bitcoin began in 2008, when a mysterious individual or group of individuals using the name “Satoshi Nakomoto” released a 9-page white paper entitled “Bitcoin: A Peer-to-Peer Electronic Cash System”. In 2009, open-source computer software was released, allowing anyone with internet access to participate in the Bitcoin network. Each unit of account is called a “bitcoin”.

Bitcoins are created as a result of network computers performing extremely complicated mathematical computations in a procedure called “mining”. The miners’ computers compete with one another to solve mathematical problems. When one of these problems is solved, which occurs approximately every 10 minutes, the system rewards the successful miner with a fixed number of new bitcoins.

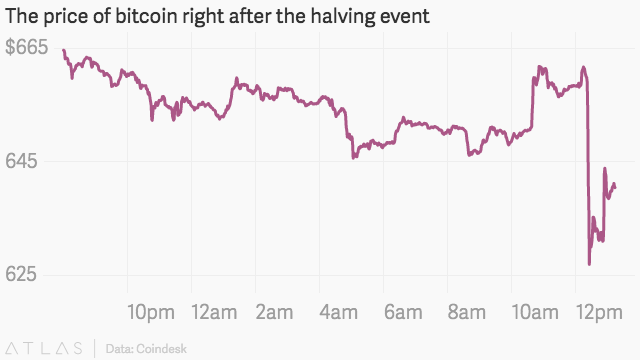

This past Saturday, in an event dubbed by some as “the Halvening,” the number of new bitcoins awarded to a miner successfully solving the mathematical algorithm fell from 25 to 12.5 bitcoins. The Halvening was brought about by the design of the original software. A “halvening” takes place approximately every 4 years, after a specific number of groups of bitcoin transactions have occurred. (To see when the next Halvening will happen, check out the TheHalvening.com.)

Mining is not the only way to acquire bitcoins; anyone can go online and purchase bitcoins for “real” currency. The exchange rate for bitcoins has fluctuated widely since its inception, with the high-point of approximately $1,200 per bitcoin occurring in late November 2013. As of July 10th, the value of a single bitcoin is approximately $650. Bitcoins may be bought and traded in fractional increments; the smallest such increment is called a “Satoshi” and is one hundredth of one millionth of a bitcoin.

Once acquired, bitcoins circulate as individuals and companies with bitcoins transfer them to those willing to accept them in payment for goods and services or for other currencies. Transfers occur online through the bitcoin network. Bitcoin miners play a crucial role in effectuating these transactions.

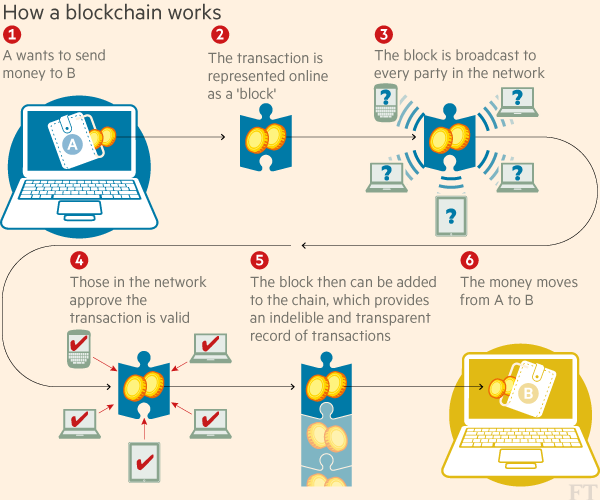

When someone proposes to transfer bitcoins, the miners (through the mathematical calculations mentioned above) verify that the would-be transferor

- (a) actually holds the bitcoins being transferred, and

- (b) has not previously transferred the bitcoins to someone else.

Source: Financial Times

After the transaction is verified, the transaction “posts” on a publicly-available ledger of all Bitcoin transactions. In the Bitcoin system, all transactions within approximately a ten-minute time span are listed together in what are called “blocks”. And each block contains information which links the block to the immediately-proceeding block. This linking together of blocks of transactions has given rise to the term “blockchain”.

Bitcoin, by the way, is not the only virtual currency out there, although it is by far the largest. The next largest, Ethereum, was in the news last month when a computer platform associated with Ethereum was hacked.

Opinions vary widely as to the desirability, and the long-term impact, of virtual currencies such as Bitcoin. Proponents of the system tout certain features, particularly its decentralized nature. No one person, company or government controls Bitcoin; it operates via the software publicly released in 2009. Others like its seeming anonymity; while every transaction is posted on the ledger, the transferors and transferees of the bitcoins in each transaction are identified by code and not by actual name. And in many ways it simplifies the transfer of value and lowers the cost of such transfers.

In my next blog post for Boxerman on Bitcoin, I will talk in a bit more detail about the blockchain, present and future, as well as certain legal issues that can arise in connection with virtual currencies.

Sorry, we couldn't find any posts. Please try a different search.

The choice of a lawyer is an important decision and should not be based solely upon advertisements.

Let's Work Together

If you have questions, we’re ready to help you find the answers.

Newsletter Sign-up

Join our mailing list and stay up to date with Capes Sokol!

By clicking the “Subscribe” button you

agree with our Terms and Conditions.