Firm Insights

Business & Corporate Transactions

Treasury Announced it Will Not Enforce the Corporate Transparency Act

On March 2, 2025, the U.S. Department of Treasury (“Treasury”) announced that: (1) it will…

Corporate Transparency Act Is Once Again Enforceable, Requiring Reporting Companies to Comply with BOI Reporting Obligations

Following months of uncertainty, the Corporate Transparency Act (the “CTA”) is once again enforceable. As…

Supreme Court Stays Injunction on the Corporate Transparency Act, But Effective Date Remains Delayed Nationwide

On January 23, 2025, the U.S. Supreme Court issued an order staying the injunction that…

U.S. Court of Appeals for the Fifth Circuit Reinstates Injunction on Corporate Transparency Act

UPDATED DECEMBER 27, 2025 In an unexpected ruling on December 26, 2024, a panel of…

Federal Court Blocks Corporate Transparency Act: Landmark Ruling Halts CTA Reporting Requirements, Including January 1, 2025 Reporting Deadline

On December 3, 2024, the United States District Court for the Eastern District of Texas enjoined…

Corporate Transparency Trap: Spotting Red Flags to Avoid CTA Scams

We all know to be wary of classic red flags in relationships—like the guy who…

Unclear Eyes, Full Courts, Can Lose? The FTC’s Non-Compete Ban in Limbo

Non-compete agreements have long been a staple in employment contracts across various industries, serving as…

Court rules that the CTA is Unconstitutional: Enforcement of the CTA in Limbo

Since the passage of the Corporate Transparency Act (“CTA”) and the implementation of the associated…

BREAKING: U.S. Department of Treasury Announces Change to Reporting Deadline for Companies Formed in 2024

The Financial Crimes Enforcement Network (FinCEN) – the agency responsible for implementing new requirements imposed…

The Corporate Transparency Act: What does a CPA need to know?

More and More Reporting to the U.S. Department of Treasury In a seemingly never-ending quest…

From Record Deals to Corporate Governance: Why I Care About the CTA

What does an IP attorney who spends his days trying to protect the work of…

Maintaining S Corporation Status – Getting Easier and Less Costly

Preventing a late or invalid S corporation election or termination is a high priority for S…

Great Scott! St. Louis EV Charger Mandates Raise Questions for Landowners & Developers

In the classic movie Back to the Future, Doc Brown feeds garbage into the DeLorean’s “Mr….

Not So Fast: President Biden Extends CDC’s Eviction Moratorium

On September 4, 2020, the Centers for Disease Control and Prevention (“CDC”), a division of the…

Does the “Economic Aid to Hard-Hit Businesses, Nonprofits, and Venues Act” Actually Soften Any Blows?

The Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (the “Act”, which Congress passed on…

We’re Back…And so is the Government with Another Round of PPP and EIDL Funding

Late in the evening of Monday, December 21, 2020, Congress passed the Consolidated Appropriations Act—a holiday…

Sweet Relief: Stimulus Bill Would Confirm PPP Borrower Tax Relief – Consolidated Appropriations Act of 2021

On December 21, 2020, Congress passed the much anticipated COVID-19 relief legislation (Consolidated Appropriations Act, 2021…

Data In, Data Out: Concerns Around PPP Loan Data Accuracy

On Monday, September 1, members of the House of Representatives’ Select Subcommittee on the Coronavirus Crisis…

Hot Off the Press: SBA Releases New FAQs on PPP Loan Forgiveness

On August 4, 2020, the Small Business Administration (“SBA”) released a new set of Frequently Asked…

Expansion of the Main Street Lending Programs: Small Businesses & Nonprofit Organizations

A brief history: On April 9, 2020, the Federal Reserve published term sheets for a lending program—known…

Paycheck Protection Flexibility Act: Changes to the Paycheck Protection Program

On June 5, 2020, President Trump signed into law the Paycheck Protection Program Flexibility Act (the “Act”), to…

Three Critical Aspects of Personal Guarantees on Business Loans

Overview Business owners are often required to sign personal guarantees on business loans. Lenders may need…

SBA and Treasury’s FAQ #46’s Certification “Safe Harbor” May Not Be As Safe As Borrowers Think

Paycheck Protection Program Loans Frequently Asked Questions On May 13, 2020, the Small Business Administration (“SBA”), along…

Federal Reserve Publishes Updated Main Street Lending Programs

On April 9, 2020, the Federal Reserve, published term sheets for a Main Street Lending Program for…

Paycheck Protection Program – We’ve talked about FAQ 31… Now What?

This article was published on May 4th and is current as of that date. On May…

Paycheck Protection Program – Treasury FAQ #31: Am I Really Supposed To Give My Money Back?

This article was published on April 30th and is current as of that date. On May…

Mid-Sized Businesses, The CARES Act Care(s) About You!

The information on this post is current as of 4/29/2020. After being signed into law on…

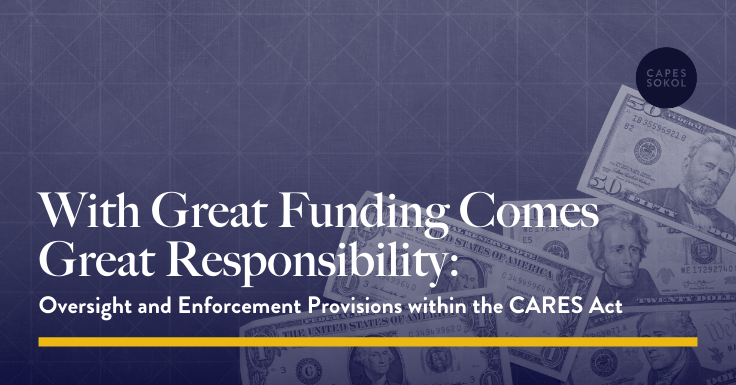

With Great Funding Comes Great Responsibility: Oversight and Enforcement Provisions within the CARES Act

On April 21, 2020, Treasury Secretary Steve Mnuchin, expressed concern that large companies – not the…

CARES Act: $200,000,000 COVID-19 Telehealth Program

Last week the FCC adopted a $200,000,000 COVID-19 Telehealth Program to provide funding to health care…

CARES Act: Summary of Provisions Supporting America’s Health Care System

On March 27, 2020, the President signed into law the Coronavirus Aid, Relief, and Economic Security…

Congress Expresses Additional CARE(s) for Small Businesses Suffering Economic Injury

SBA’s Disaster Assistance Loan in the Age of COVID-19: “Economic Injury Declaration” by SBA Required for…

Businesses Should CARE(s) About This: The SBA Is Releasing New Information Regarding 7(a) Loans

SBA: Paycheck Protection Program Late on Tuesday, March 31, 2020, the Small Business Administration (the “SBA”)…

CARES Act: Paycheck Protection Program Provides Small Businesses an Opportunity for Relief

DISCLAIMER:mPlease note this blog post relates to a different program than the “Emergency EIDL Grants” program…

Coronavirus Aid, Relief, and Economic Security (“CARES”) Act: Payroll Tax Implications

The Coronavirus Aid, Relief, and Economic Security (“CARES”) Act includes two very important payroll tax provisions:…

Strain, Strain, Go Away, I’ll Perform Another Day: COVID-19 Force Majeure Claims in Missouri

The latest strain of coronavirus, COVID-19, has many wondering about potential force majeure claims. Please note…

SBA’s Disaster Assistance Loan in the Age of COVID-19: “Economic Injury Declaration” by SBA Required for Missouri

In order to minimize disruption to small businesses, on Tuesday, March 17, 2020, the U.S. Small Business Administration issued…

COVID-19 Quandary – Healthcare at a Time of Social Distancing

Most health experts agree that social distancing is essential to minimize the spread of the novel…

Gin & Pelotonic: An Exercise in Restraint

Peloton, a seller of stationary bikes and other exercise equipment, recently released a now-infamous commercial titled…

“Play Gloria” (and Trademark and Copyright It, Too?)

It would be difficult now to find someone in St. Louis unaware of the “Play Gloria”…

Nothing Lasts Forever . . . Non-Compete Agreements Included

Successful companies make significant investments in their employees in the form training, relationships, sharing confidential or…

Don’t Get Swept Away: Missouri Sweepstakes Laws

One would be hard-pressed to find someone unaware of the McDonald’s Monopoly Sweepstakes. In 1987, McDonald’s…

Regulated Under Existing Laws, Digital Assets Offer New Investment Opportunities

This article was originally published in the St. Louis Lawyer published by The Bar Association of…

Initial Coin Offerings: The Securities and Exchange Commission’s View

Part Two of Three: In my prior blog post in this series, I described generally how…

Tainted Love: Starting a Business Without an Operating Agreement

In honor of Valentine’s Day, I’d like to share a twist on a classic love story…

Amending LLC and Partnership Agreements for Changes in Partnership Tax Audits

Effective as of tax years beginning in 2018, the rules for how the IRS audits companies…

Total Eclipse of the Yard – Adverse Possession Law in Missouri

The Great American Solar Eclipse is scheduled to cross through the United States from coast to…

Boxerman on Bitcoin – Part I: An Introduction to Bitcoin

Yes, It’s Legal. A Brief Overview of Bitcoin and Bitcoin-Related Issues In recent years, our firm’s…

An “Off The Shelf” Buy-Sell Provision May Not Work For Many Missouri Business Owners

When a new business is formed by two or more owners, just like a new marriage,…

Missouri’s New Series LLC Law

Late this past summer, the State of Missouri enacted legislation permitting the formation of a new…