Firm Insights

White Collar Crimes & Internal Investigations

AI, IP & Your Business: The Legal Risk of Calling AI-Created Work “Custom”

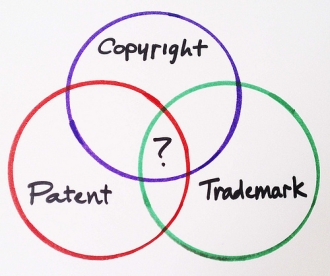

If copyright law protects content. And trademark law protect brands. Then advertising law protects consumers. And…

AI, IP & Your Business: Why AI Is a Trademark Minefield for Business Owners

If copyrights protect content, trademarks protect brands. Trademarks cover the names, logos, slogans, and other…

From Patchwork to Predictability: Missouri’s Eviction Rules in 2025

Economic uncertainty continues to put pressure on both tenants and property owners. Rising living costs,…

Missouri Tax Legislation Update: Elimination of Income Tax on Individuals’ Capital Gains and Sales Tax on Diapers, Feminine Hygiene Products, and Incontinence Products

New law passed by the Missouri legislature in late May, which Governor Mike Kehoe signed…

Myths About Foreclosure

Anyone who has been on the wrong end of the foreclosure process knows how stressful…

“Forget the pod bay doors, Hal. How ‘bout a good reading list?” — Yes, Another Creepy AI Tale

In a prior post, I told the disturbing true tale highlighting the dangers of delegating…

Missouri’s New Paid Sick Time Law: What Employers Need to Know

As of May 1, 2025, employers in Missouri must comply with Proposition A, Missouri’s Paid…

Navigating the Landlord and City Approval Maze in Experiential Retail

Experiential retail has emerged as a game-changer in the world of brick-and-mortar stores, offering immersive,…

Legal Precedent on Attorney’s Privilege to File Notice of Lis Pendens

Odermann v. Mancuso, 670 SW3d 461 (Mo. App. W.D. 2023), a recent decision from the…

Treasury Announced it Will Not Enforce the Corporate Transparency Act

On March 2, 2025, the U.S. Department of Treasury (“Treasury”) announced that: (1) it will…

Corporate Transparency Act Is Once Again Enforceable, Requiring Reporting Companies to Comply with BOI Reporting Obligations

Following months of uncertainty, the Corporate Transparency Act (the “CTA”) is once again enforceable. As…

Drake vs. Kendrick Lamar: A Defamation Battle in the Streaming Era

The hip-hop world has been ablaze with the feud between megastars Kendrick Lamar and Drake,…

Navigating the Uncertainty: Counterclaims in Unlawful Detainer Actions in Missouri

The legal landscape surrounding unlawful detainer actions in Missouri is riddled with uncertainty, particularly when…

Supreme Court Stays Injunction on the Corporate Transparency Act, But Effective Date Remains Delayed Nationwide

On January 23, 2025, the U.S. Supreme Court issued an order staying the injunction that…

U.S. Court of Appeals for the Fifth Circuit Reinstates Injunction on Corporate Transparency Act

UPDATED DECEMBER 27, 2025 In an unexpected ruling on December 26, 2024, a panel of…

Federal Court Blocks Corporate Transparency Act: Landmark Ruling Halts CTA Reporting Requirements, Including January 1, 2025 Reporting Deadline

On December 3, 2024, the United States District Court for the Eastern District of Texas enjoined…

Donald J. Trump Strikes Again . . . and Again . . . and Again!

As I have written before, Donald J. Trump has proven over and over to be…

Understanding Waivers of Subrogation in Commercial Leases

When navigating the complexities of commercial leases, you might encounter the term “waiver of subrogation.”…

Corporate Transparency Trap: Spotting Red Flags to Avoid CTA Scams

We all know to be wary of classic red flags in relationships—like the guy who…

Unclear Eyes, Full Courts, Can Lose? The FTC’s Non-Compete Ban in Limbo

Non-compete agreements have long been a staple in employment contracts across various industries, serving as…

Hen-dependence Day: Missouri Law Lets Homeowners Keep Chickens, HOA or Not

On July 9, 2024, Governor Parsons signed HB 2062, which overrules homeowners’ association (“HOA”) restrictions…

From Hoosier to Habeas: The Hazards of Legalese

This all began a week or so ago when I was strolling past a popular…

Court rules that the CTA is Unconstitutional: Enforcement of the CTA in Limbo

Since the passage of the Corporate Transparency Act (“CTA”) and the implementation of the associated…

Behind the Music Ban: Who Pays the Price When UMG and TikTok Fight?

Whether you are a content creator, musical artist, or someone like me who often (shamelessly)…

BREAKING: U.S. Department of Treasury Announces Change to Reporting Deadline for Companies Formed in 2024

The Financial Crimes Enforcement Network (FinCEN) – the agency responsible for implementing new requirements imposed…

The Corporate Transparency Act: What does a CPA need to know?

More and More Reporting to the U.S. Department of Treasury In a seemingly never-ending quest…

From Record Deals to Corporate Governance: Why I Care About the CTA

What does an IP attorney who spends his days trying to protect the work of…

Property Reassessment Survival Guide: Why Is My Property Being Reassessed?

What is Property Reassessment? Missouri law requires every county assessor (and the St. Louis City…

A Trademark for Trump’s Private Part? The Gift that Goes on Giving

Ready? How about a copyright claim over a farting doll named Pull My Finger Fred? Or…

Artificial “Intelligence”? A Cautionary Tale Starring the ChatBot Associate from Hell

As both a trial attorney and the author of novels, I have learned to heed…

LLCs Taxed as S Corporations: Welcome Relief for Inadvertent “S” Failures

A Disaster Waiting to Happen Picture it: The year is 2003. You are an owner…

Fair Use Face-Off: Warhol vs. Goldsmith – Unpacking the Unexpected Ruling

Yesterday morning the Supreme Court issued its long-awaited ruling in one of the most closely-watched…

The Cost of Streaming: How TV Writers and Musicians Are Paying the Price for Your Binge-Watching Habits

How can there be a writer’s strike when we’re living in a time of unprecedented…

The Power of Mediation: Lessons Learned from the Trenches

Mediation is a powerful and efficient way to resolve conflict by having honest and open communication. …

Part II-C of Bittner: The Dark Lining Behind the Silver Cloud

This morning, the Supreme Court issued what lawyers correctly regard as a taxpayer-friendly opinion in the…

The Power of Mediation: The Path to Healthy Resolution

In many cases, clients (even the ones who win) wish that they had found an alternative…

Maintaining S Corporation Status – Getting Easier and Less Costly

Preventing a late or invalid S corporation election or termination is a high priority for S…

A Truly Kinky Salute to the 2023 Public Domain Day

Last year at this time I welcomed the annual Public Domain Day with an apt quote…

Is Donald Trump’s You-Know-What Too Tiny to Trademark? Trumped Again in a “Small” 1st Amendment Triumph

Ever since he rode down that Trump Tower gold escalator in June of 2015 to launch…

How’s My Post? Dial 1-800-EYE-ROLL: Life in a Fuct Trademark Universe

It started as an ordinary traffic stop—waiting for the light to turn green, thoughts drifting aimlessly,…

Great Scott! St. Louis EV Charger Mandates Raise Questions for Landowners & Developers

In the classic movie Back to the Future, Doc Brown feeds garbage into the DeLorean’s “Mr….

A Copyright Riddle: When Is Copying Not an Infringement?

Many view my fellow copyright lawyers as the Glamor Guys and Gals of the legal profession—at…

Winnie-the-Pooh and Hemingway Too: Happy Public Domain Day

“It isn’t much good having anything exciting, if you can’t share it with somebody.” Well, guess…

Trademarks, Pelotons, and Heart Attacks: The Sex in the City Trifecta

We who toil in the field of intellectual property have our own NSFW collection of cases…

Who You Calling a Broker? The Infrastructure Bill’s Impact on Cryptocurrency

In 2016, the Treasury Inspector General for Tax Administration (“TIGTA”) recommended that the IRS “revise third-party…

Better Late Than Never: The Wayfair Impact & Missouri’s New Sales Tax Legislation

Over the past decade, online retail has exploded – for many sellers, it is now almost…

Tonto, Chief Noc-A-Homa, and Oblivious Bias: Is There a Vaccine for That?

“Surrounded by dozens of hostile Indians on horseback waving guns and tomahawks, the Lone Ranger turns…

BBQ with a Side of Business Interruption: KC Court Finds Restaurant’s COVID-19 Insurance Claim Covered

The path to a business interruption insurance payout for companies shuttered by the COVID-19 pandemic has…

The Bernie Sanders Meme Keeps on Giving: Analyzing the Copyright and Right of Publicity Issues When an Image Goes Viral

Presumably everyone has now seen the viral meme featuring a photograph of Senator Bernie Sanders sitting…

Not So Fast: President Biden Extends CDC’s Eviction Moratorium

On September 4, 2020, the Centers for Disease Control and Prevention (“CDC”), a division of the…

Relief for Copyright Owners: COVID-19 Relief Bill Contains a Significant Change to the Copyright Enforcement Process

Tucked into the end-of-year COVID-19 relief Consolidated Appropriations Act enacted on December 27, 2020 was a…

Does the “Economic Aid to Hard-Hit Businesses, Nonprofits, and Venues Act” Actually Soften Any Blows?

The Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (the “Act”, which Congress passed on…

The 11th Hour: Tax Planning for the Final Days of 2020

If there is one word that can describe tax planning for a broad cross-section of America…

We’re Back…And so is the Government with Another Round of PPP and EIDL Funding

Late in the evening of Monday, December 21, 2020, Congress passed the Consolidated Appropriations Act—a holiday…

Sweet Relief: Stimulus Bill Would Confirm PPP Borrower Tax Relief – Consolidated Appropriations Act of 2021

On December 21, 2020, Congress passed the much anticipated COVID-19 relief legislation (Consolidated Appropriations Act, 2021…

New COVID-19 Relief Bill is Filled with Tax Provisions – Consolidated Appropriations Act of 2021

On December 21, 2020, Congress passed the much anticipated COVID-19 relief legislation (Consolidated Appropriations Act, 2021…

The Silk Road and Me: Why My Bitcoin (And Probably Yours, Too) is Safe from Government Seizure

Ok, I admit it. This blog post began purely out of selfishness. I read about the…

Government Proposes Below-Guidelines Sentence: This Time, for the Right Reasons

When higher-ups in the Department of Justice intervened in the sentencing phase of the criminal case…

The Brown Recluse and Hope for Pandemic Shuttered Missouri Businesses: Business Interruption Policies May Cover COVID-19 Losses

In one of our prior blogs, we predicted the first round of COVID-19 business interruption coverage…

Data In, Data Out: Concerns Around PPP Loan Data Accuracy

On Monday, September 1, members of the House of Representatives’ Select Subcommittee on the Coronavirus Crisis…

This Lawsuit’s For You: Neil Young v. Donald Trump in the Copyright Infringement Ring

Rocker Neil Young has re-invented himself many times throughout his long and illustrious career – from…

Hot Off the Press: SBA Releases New FAQs on PPP Loan Forgiveness

On August 4, 2020, the Small Business Administration (“SBA”) released a new set of Frequently Asked…

Who’s a Trademark Knucklehead Now? From Covfefe to COVID-19 to Aunt Jemima

These have been strange times for all of us, and uniquely strange to those toiling in…

How a 100-Year Pandemic Causes “Direct Physical Loss” and Triggers Business Interruption Insurance Coverage

Since the outset of the COVID-19 pandemic, the insurance industry has told anyone who will listen…

A Hurricane Named Coronavirus: Why Virus Exclusions May Not Defeat COVID-19 Business Interruption Claims

To put it mildly, many businesses continue to struggle with disruptions caused by the COVID-19 pandemic….

Expansion of the Main Street Lending Programs: Small Businesses & Nonprofit Organizations

A brief history: On April 9, 2020, the Federal Reserve published term sheets for a lending program—known…

Paycheck Protection Flexibility Act: Changes to the Paycheck Protection Program

On June 5, 2020, President Trump signed into law the Paycheck Protection Program Flexibility Act (the “Act”), to…

Three Critical Aspects of Personal Guarantees on Business Loans

Overview Business owners are often required to sign personal guarantees on business loans. Lenders may need…

What Do Early COVID-19 Lawsuits Teach Employers about Necessary Return to Work Protocols? How Can Employers Avoid Liability?

It is widely predicted that COVID-19 related lawsuits will flood the court systems in the coming…

COVID-19 Construction Contract Considerations

Stay-at-home orders and the economic disruption caused by the COVID-19 pandemic have taken their toll on…

SBA and Treasury’s FAQ #46’s Certification “Safe Harbor” May Not Be As Safe As Borrowers Think

Paycheck Protection Program Loans Frequently Asked Questions On May 13, 2020, the Small Business Administration (“SBA”), along…

Workplace Screening For Employees Returning to Work During the COVID-19 Pandemic

As businesses in Missouri and other regions begin to open back up and employees return to…

Federal Reserve Publishes Updated Main Street Lending Programs

On April 9, 2020, the Federal Reserve, published term sheets for a Main Street Lending Program for…

PPP Loan Forgiveness Comes with a Price: Lost Deductions

For any employer that expected PPP loan proceeds to be “free money,” the IRS has essentially…

Paycheck Protection Program – We’ve talked about FAQ 31… Now What?

This article was published on May 4th and is current as of that date. On May…

Paycheck Protection Program – Treasury FAQ #31: Am I Really Supposed To Give My Money Back?

This article was published on April 30th and is current as of that date. On May…

Mid-Sized Businesses, The CARES Act Care(s) About You!

The information on this post is current as of 4/29/2020. After being signed into law on…

With Great Funding Comes Great Responsibility: Oversight and Enforcement Provisions within the CARES Act

On April 21, 2020, Treasury Secretary Steve Mnuchin, expressed concern that large companies – not the…

CARES Act: $200,000,000 COVID-19 Telehealth Program

Last week the FCC adopted a $200,000,000 COVID-19 Telehealth Program to provide funding to health care…

CARES Act: Summary of Provisions Supporting America’s Health Care System

On March 27, 2020, the President signed into law the Coronavirus Aid, Relief, and Economic Security…

Changes During COVID-19: Gift Tax Return and Payment of Tax Postponed but Additional Tax Postponements and Clarifications Requested

On March 18, 2020, in response to the COVID-19 pandemic, the Treasury Department (“Treasury”) and the…

Families First Coronavirus Response Act Leave: Department of Labor Issues Temporary Regulations

On April 1, 2020, the Department of Labor (DOL) issued temporary regulations to implement public health…

Congress Expresses Additional CARE(s) for Small Businesses Suffering Economic Injury

SBA’s Disaster Assistance Loan in the Age of COVID-19: “Economic Injury Declaration” by SBA Required for…

Businesses Should CARE(s) About This: The SBA Is Releasing New Information Regarding 7(a) Loans

SBA: Paycheck Protection Program Late on Tuesday, March 31, 2020, the Small Business Administration (the “SBA”)…

CARES Act: Paycheck Protection Program Provides Small Businesses an Opportunity for Relief

DISCLAIMER:mPlease note this blog post relates to a different program than the “Emergency EIDL Grants” program…

Coronavirus Aid, Relief, and Economic Security (“CARES”) Act: Payroll Tax Implications

The Coronavirus Aid, Relief, and Economic Security (“CARES”) Act includes two very important payroll tax provisions:…

From COVFEFE to COVID: The Knucklehead Trademark Saga Continues

Back in July of 2017, I posted a piece entitled “Trademark Tales: Covfefe® Really?” My focus…

People First Initiative: IRS to Provide Additional Relief to Taxpayers in Response to COVID-19

On Wednesday March 25, 2020, the IRS announced a new initiative focused on temporary relief for…

Wage and Overtime Basics for the Homebound COVID-19 Workforce

Over the past decade many employers have gradually permitted and, at times, even expected employees to…

Federal Agencies Cracking Down on Coronavirus-Related Criminal Behavior

A memorandum to all United States Attorneys issued last week by Attorney General William Barr directed:…

COVID-19 Consequence: Tax Filing and Payment Deadlines Extended

The federal and Missouri state governments have announced consistent and simple automatic relief from the April…

Strain, Strain, Go Away, I’ll Perform Another Day: COVID-19 Force Majeure Claims in Missouri

The latest strain of coronavirus, COVID-19, has many wondering about potential force majeure claims. Please note…

Families First Coronavirus Response Act: Paid Medical Leave and Paid Sick Leave for Employees

On March 18, 2020, President Trump signed into law the Families First Coronavirus Response Act (“the…

SBA’s Disaster Assistance Loan in the Age of COVID-19: “Economic Injury Declaration” by SBA Required for Missouri

In order to minimize disruption to small businesses, on Tuesday, March 17, 2020, the U.S. Small Business Administration issued…

COVID-19 Consequence: Tax Payment Deadlines Extended

Please note, this post was originally posted on March 18, 2020. Due to quickly developing changes,…

COVID-19 Quandary – Healthcare at a Time of Social Distancing

Most health experts agree that social distancing is essential to minimize the spread of the novel…

A Warning to Real Estate Developers: Beware of Graffiti Artists

A federal court of appeals has just upheld a $6.5 million verdict against a real estate…

Three Factors to Consider in Forbearance Agreements: Waiver of Claims, Additional Collateral & Actual Forbearance by the Bank

Business borrowers that find themselves in default on a promissory note or other credit facility may…

It’s Official (Sort Of): Virtual Currency Need Not Be Reported on FBARs

Ever since virtual currencies such as Bitcoin appeared on the scene, a multitude of questions has…

Gin & Pelotonic: An Exercise in Restraint

Peloton, a seller of stationary bikes and other exercise equipment, recently released a now-infamous commercial titled…

Settle Your Illinois Tax Bill for Less: Illinois Offers Tax Amnesty Program to Relieve Interest and Certain Penalties

On June 5, 2019, the Illinois legislature passed the 2019 Illinois Tax Delinquency Amnesty Act, which…

The Best Deal in Town: Buying Peace from Excess Litigation by Interpleading Policy Limits

Recent amendments to Missouri’s interpleader statute (RSMo § 507.060) provide significant protection for liability insurers seeking…

#SociallySponsored: How to Comply with FTC Regulations

Following up on last year’s blog post about how easy it is for a sweepstakes (often…

Rights Clearance for Video Content: Four Key Agreements to Ease the Pain

Probably the least enjoyable part of producing audiovisual content for screens – but one of the…

Can I Prepare that Return?: Missouri Provides Guidance for CPAs on Marijuana-Industry Clients

This week, the Missouri Board of Accountancy released a comment concerning Amendment 2 to the Missouri…

Old Law, New Tricks: How Blockchain Could Innovate the Real Estate Industry

Last week members of Capes Sokol’s Business and Real Estate Practice Group attended a CLE webinar…

Significant Changes to Missouri Trial Practice: Senate Bill No. 7 and Senate Bill No. 224

On Wednesday, Governor Parson signed into law Senate Bill 224, which will bring the Missouri Supreme…

Significant Changes Coming to Missouri Trial Practice: How Senate Bill 224 Falls Short

In this final installment of our four-part series, we analyze areas in which the Missouri Supreme…

“Play Gloria” (and Trademark and Copyright It, Too?)

It would be difficult now to find someone in St. Louis unaware of the “Play Gloria”…

Significant Changes Coming to Missouri Trial Practice: Claw Back Procedures

Last week, Capes Sokol’s Litigation Group discussed legislation recently passed by the Missouri Legislature that is…

Significant Changes Coming to Missouri Trial Practice: Discovery Limits

Last week, Capes Sokol’s Litigation Group outlined some potential significant changes to Missouri’s joinder and venue…

Significant Changes Coming to Missouri Trial Practice: Joinder and Venue

The Missouri Legislature concluded its 2019 session with the passage of two bills that, if signed…

Nothing Lasts Forever . . . Non-Compete Agreements Included

Successful companies make significant investments in their employees in the form training, relationships, sharing confidential or…

Missouri Supreme Court Holds Joinder Cannot Establish Venue

The Missouri Supreme Court has held that permissive joinder of separate claims cannot extend venue to…

Are We Fuct? The Supreme Court to Answer this Trademark Question

My favorite scene in the movie National Lampoon’s Christmas Vacation: Christmas Eve. A knock at the…

UPDATE: You Might Have to Give the Government the Finger After All

Recently I wrote about a decision of United States Magistrate Judge Kandis A. Westmore denying the…

Now We All Can Take That Road Not Taken: The Copyright Freeze Has Melted!

January 1st marked the start of a truly happy new year for those who make their…

You Don’t Have to Give the Government the Finger: Judge Denies Warrant Application Requiring Suspect to Unlock Cell Phone

A decision handed down last week by a federal judge in Oakland, California, could – if…

IRS Announces Penalty Relief for Some 2018 Underwithholders

The IRS announced yesterday that it will excuse some taxpayers who underwithheld or failed to pay…

Beers, Brands, and Brawls—When a Name is More than Just a Name

“What’s in a name?” Juliet asks in Act II of Shakespeare’s Romeo and Juliet. “A rose…

Don’t Get Swept Away: Missouri Sweepstakes Laws

One would be hard-pressed to find someone unaware of the McDonald’s Monopoly Sweepstakes. In 1987, McDonald’s…

I’m Not Withholding on You: Employment Tax Enforcement Remains a Priority

Last week, I had the pleasure of attending the New York University 10th Annual Tax Controversy…

South Dakota v. Wayfair: The End of the “Physical Presence” Test and the Future Reach of Sales Tax

In a 5-4 decision this morning, the Supreme Court upheld the South Dakota law requiring certain…

Take Two: AICPA Tries Again for IRS Guidance on Virtual Currency Taxation

About two weeks ago, the American Institute of Certified Public Accountants – “the world’s largest member…

Bitcoin Pizza Day: Digital Currency Attorneys Celebrate the $80 Million Pizza Order

On this day in 2010, the first reported purchase of a consumer product using Bitcoin took…

Regulated Under Existing Laws, Digital Assets Offer New Investment Opportunities

This article was originally published in the St. Louis Lawyer published by The Bar Association of…

Guidance before Compliance: Bitcoin, Taxes and IRS Notice 2014-21

For years, taxpayers who engage in virtual currency transactions, and the lawyers and accountants who advise…

Initial Coin Offerings: Uncertain Tax Consequences

Part Three of Three: In the prior blog posts in this series, I described generally how…

Initial Coin Offerings: The Securities and Exchange Commission’s View

Part Two of Three: In my prior blog post in this series, I described generally how…

Make America Naughty Again: The Risk of Risqué Trademarks

Two years ago, in a post entitled “Is Your Brand Naughty or Nice? The New Santa…

Tax Code Section 104: Disparate Treatment of Settlement Proceeds

Tax Code Section 104(a)(2) provides that “damages (other than punitive damages) received … on account of…

Initial Coin Offerings: A Primer and Suggestion of Impending Issues

Part One of Three: This is the first of a three-part blog series. In this post,…

Tainted Love: Starting a Business Without an Operating Agreement

In honor of Valentine’s Day, I’d like to share a twist on a classic love story…

Passport to Nowhere: What IRS Notice 2018-1 Means for “Seriously Delinquent” Taxpayers

The IRS published its first notice of the year this past Friday – Notice 2018-1 –…

What Goes Up, Must . . . Get Taxed? Tax Issues with Virtual Currency

Bitcoin, and other virtual currencies, had a heck of a year in 2017. Bitcoin started the…

Amending LLC and Partnership Agreements for Changes in Partnership Tax Audits

Effective as of tax years beginning in 2018, the rules for how the IRS audits companies…

Total Eclipse of the Yard – Adverse Possession Law in Missouri

The Great American Solar Eclipse is scheduled to cross through the United States from coast to…

Trademark Tales: Covfefe® Really?

A lexicographer’s task of pinning down a word’s origin can often mean hours, and even days,…

Former Tax Court Judge Sentenced to Prison Time

For those of you following the case of the Tax Court Judge turned Tax Fraud Defendant,…

Income Tax Savings Opportunity: Credit Shelter Trust vs. Marital Trust

No one likes the idea of paying taxes, and having a “gross estate” for estate tax…

Land of the Lost Trade Secrets: A Cautionary Tale

Trade secrets are among an enterprise’s most valuable assets, often more important than its other forms…

A Changing Legal Landscape for Short-Term Property Rentals in Missouri

Since my review of important considerations for short-term property rental hosts in June 2016, the home…

Motivated for Change: Missouri’s Employment Discrimination Law Set for Transformation

In response to criticism that Missouri’s employment discrimination law, the Missouri Human Rights Act[1] (“MHRA”), has…

Healthy Public Schools = A Healthy St. Louis

Shortly after his January 9, 2017 inauguration, Governor Eric Greitens announced how he plans to cut…

Securities Fraud: Some Gifts are Better Left Unopened

It’s once again the time of year when many people exchange gifts with family members and…

My Muffin Has How Many Calories??? Understanding the New FDA Menu Labeling Requirement

Given the option, many would choose to live in blissful ignorance regarding the number of calories…

Is Less Really More? The Continuing Rise of Slack Fill Litigation

Slack fill litigation against food, beverage and consumer goods producers is flourishing. The primary allegation in…

Haunted Houses: Disclosing Spooky Activity in the State of Missouri

While many people seek to be spooked during the month of October leading up to Halloween—homebuyers…

Former Tax Court Judge Pleads Guilty to Criminal Tax Fraud

This past April, I wrote about a federal indictment returned against Diane L. Kroupa, a former judge…

TEFRA Repeal: Opting Into the New Partnership Tax Audit Regime?

Last December, a new law known as the Bipartisan Budget Act of 2015 (the “BBA”) (P.L….

Felony [sic] Stealing—The Case of State v. Bazell

The Supreme Court of Missouri recently issued an opinion that sent prosecutors across the state scrambling….

Marx Bros. v. Warner Bros. – An Amusing Lesson in the Dangers of Trademark Bullying

A few months ago, the Journal of the Missouri Bar published a superb article by a…

Donald Trump v. Mick and Keith: You Can’t Always Play What You Want

Back in June of 2015, on the day he launched his campaign for the Republican presidential…

Boxerman on Bitcoin – Part II: Blockchain and Legal Issues that Can Arise With Virtual Currency

In my previous blog post, I provided a very basic overview of Bitcoin, the most prominent…

Boxerman on Bitcoin – Part I: An Introduction to Bitcoin

Yes, It’s Legal. A Brief Overview of Bitcoin and Bitcoin-Related Issues In recent years, our firm’s…

Thanks a Latté, Starbucks: A Cautionary Tale of [Allegedly] False Advertising

Starbucks recently was sued in the United States District Court for the Northern District of California…

Important Considerations for Short-Term Property Rental Hosts in Missouri

The “sharing economy” (also known as the “peer economy” or “gig economy”) in which individuals earn…

Out with the Old…in with the NEW Missouri eFiling System

Progress is painful, or so it has been said. But, sometimes, it need not be as…

HUSH! Can You Keep a “Trade” Secret?

Let’s play a word association game. I say “Intellectual property.” Your three most likely responses are:…

Landlords Beware: Tenant Improvements Subject Owners to Mechanic’s Liens

In construction law, there is no better bargaining chip than the threat of a mechanic’s lien,…

Offshore Entities in Tax Havens: The Panama Papers Explained

It has been about three weeks since the release of the “Panama Papers” set news outlets…

From Tax Court Judge to Tax Fraud Defendant

Arsenio Hall, a late night TV talk show host from the early 1990s, had a segment…

An “Off The Shelf” Buy-Sell Provision May Not Work For Many Missouri Business Owners

When a new business is formed by two or more owners, just like a new marriage,…

Trump Campaign Focuses Spotlight on Assault and Battery

On March 8, 2016, following a Trump campaign event at the Trump National Golf Club in…

The Case of the Impenetrable Apple iPhone

The United States Government and Apple are in the midst of a significant standoff. The Government…

Now is the Time to Prepare for a Sea Change in Partnership Tax Audits

For owners of limited liability companies (“LLCs”) and partners in partnerships, life in a tax audit…

Five Reasons Why A Lawyer is Vital for Commercial Property Assessment Litigation

Following an unsuccessful Board of Equalization hearing, commercial real estate owners often call upon me to…

Does Justice Scalia’s Death Signal the Fall of Arbitration?

Justice Antonin Scalia was best known for his scathing opinions, often in cases split along ideological…

Is Your Brand Naughty or Nice? The New Santa at the Trademark Office

I met my wife in high school. On our first date, I took her to an…

Judicially Estopped – 8th Cir. Court of Appeals Affirms Summary Judgment

The Eighth Circuit Court of Appeals recently affirmed a District Court’s summary judgment that a party…

New Landlord Licensing Requirements in St. Louis County

On December 31, 2015, St. Louis County Ordinance 26,211, the “Residential Rental Property Licensing Code,” (the…

Will Dodd-Frank Encourage a Repeat of the Housing Bubble?

It appears that rule-making agencies are likely to gut a provision from the Dodd-Frank financial overhaul…

Missouri’s New Series LLC Law

Late this past summer, the State of Missouri enacted legislation permitting the formation of a new…

Revisions to Missouri Mechanic’s Lien Statute Impact Residential Projects

On August 28, 2010, a new section of the Missouri Mechanic’s Lien Statute (Chapter 429 MO…